South Florida is Drowning in Water Loss Claims…Hold on to Your Wallet

The following article by Robert Hurtibise, Contact Reporter, appeared in the 5/22/16 money section of the Fort Lauderdale Sun-Sentinel. It encapsulates the issues surrounding the homeowners insurance market in our state with particular attention paid to the South Florida region.

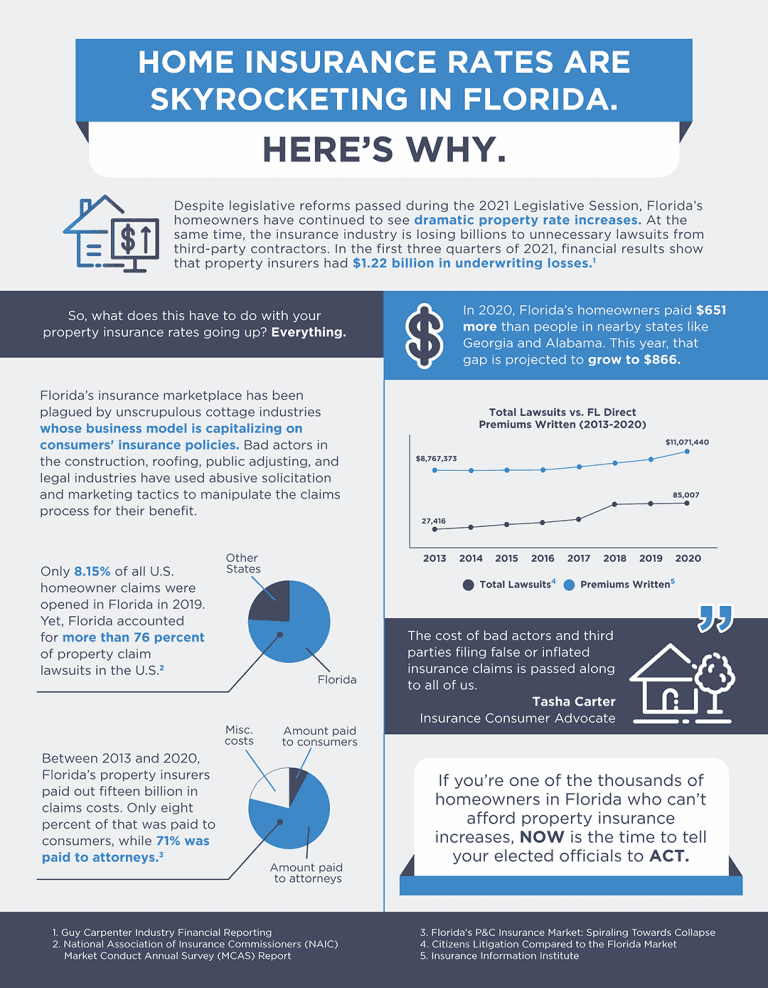

South Florida property insurance agents say they’re preparing for rate increases as state regulators approve requests to offset higher costs of water damage claims.

So far this year, the state approved a 5.5 percent statewide average increase by Federated National Insurance Co., which has the sixth-largest share of the tri-county market – 54,469 policies at the end of 2015, according to state records.

Tower Hill secured approval for an average 13.1 percent rate increase for its Select insurance line and an average 8.2 percent increase for its Preferred line.

But several other rate increase requests are still pending review by the state Office of Insurance Regulation, including an average 2.6 percent increase on Universal Property & Casualty’s personal lines policies. Of those, multi-peril residential policies, which bundle hurricane risk and other perils, would increase an average of 5 percent if approved.

Universal insured 192,808 residences, including rentals, in the tri-county area at the end of the 2015, second only to state-run Citizens Property Insurance Corp., with 236,029.

Citizens, which has been warning regulators, politicians and policyholders about increasing water-damage claims and assignment-of-benefits abuses, increased its 2016 rates an average of 3.2 percent. The brunt of those increases are being felt in South Florida, including an average of 4.8 percent in Broward County and 6.2 percent in Miami-Dade County. The company is warning of even larger increases in the years to come if claims abuses are not curbed.

Click here to read the rest of the article on SunSentinel.com