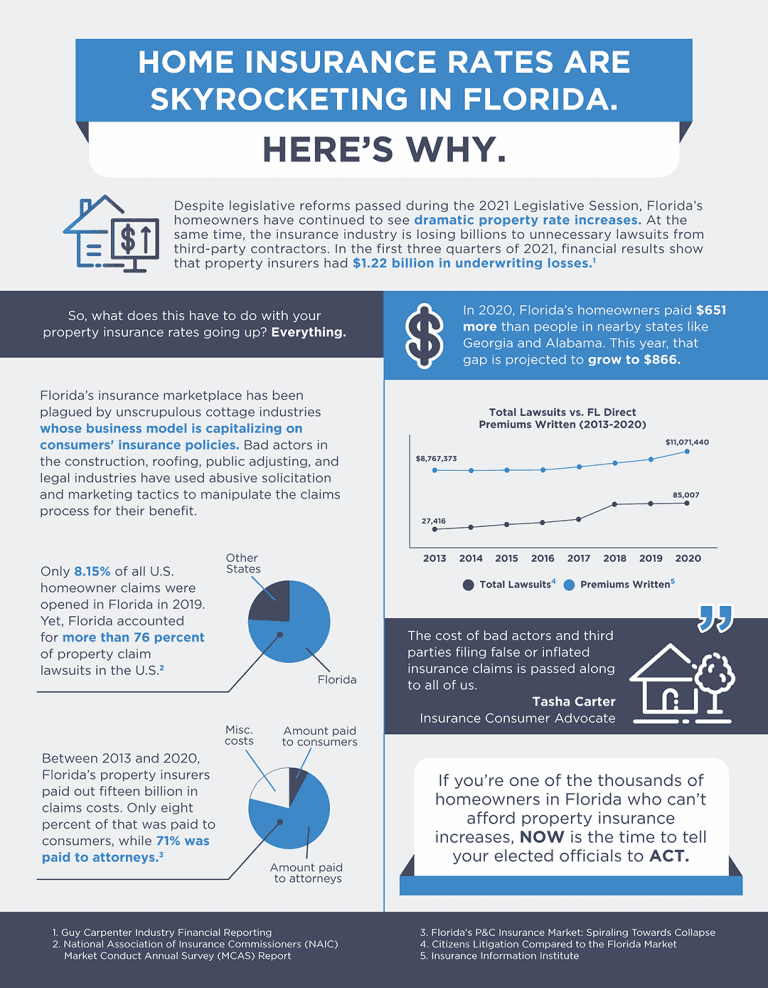

Home Insurance Rates Are Skyrocketing in Florida. Here’s Why.

Despite legislative reforms passed during the 2021 Legislative Session, Florida’s homeowners have continued to see dramatic property insurance rate increases. At the same time, the insurance industry is losing billions to unnecessary lawsuits from third-party contractors. In the first three quarters of 2021, financial results show that property insurance had $1.22 billion in underwriting losses.1…