What is a 4-Point Inspection for Homeowners?

As a homeowner, you may have heard the term 4-point inspection thrown around, but what does it actually mean? A 4-point inspection is a type of home inspection that focuses on four main areas: the roof, plumbing, electrical, and HVAC systems. It’s commonly required by insurance companies as a way to assess the risk of insuring an older home. However, even if your home isn’t particularly old, it’s always a good idea to get a 4-point inspection to ensure that these crucial systems are functioning properly and to catch any potential issues before they become major problems. In this post, we’ll take a closer look at what a 4-point inspection entails, why it’s important, and what you can expect from the process.

1. What Will Insurance Companies Look For During a 4-Point Inspection?

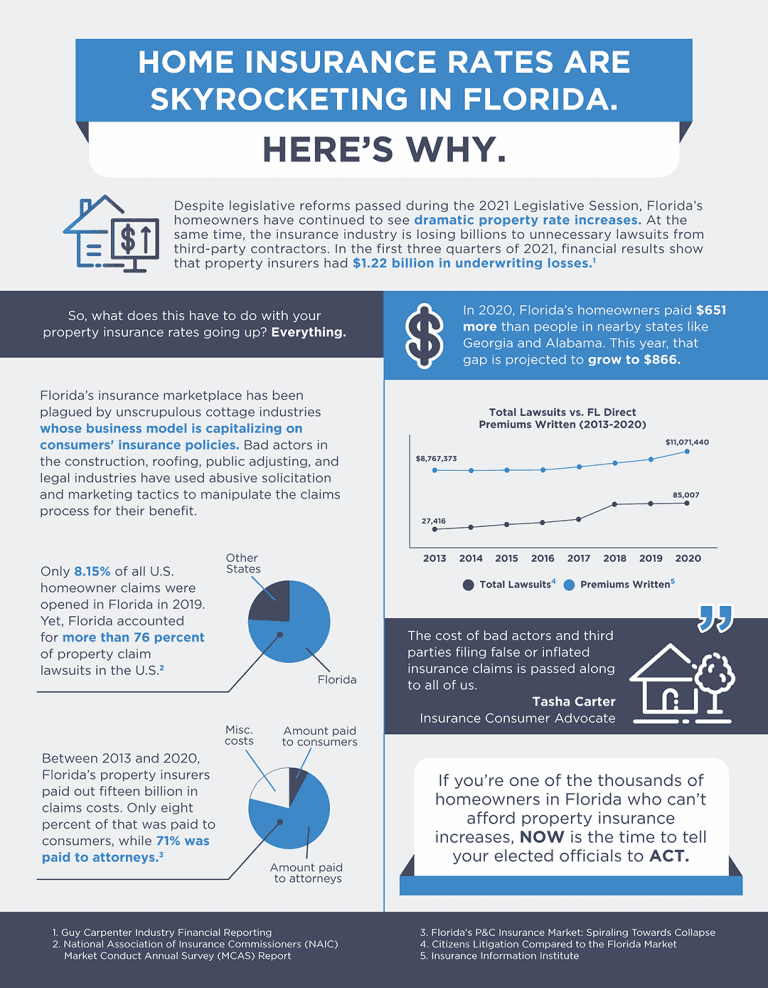

A 4-point inspection typically covers the four major systems of a home, including electrical, plumbing, HVAC, and the roof. Insurance companies often require this inspection before issuing a policy. This type of inspection is especially important in Florida, where hurricanes and strong storms can cause significant damage to a home’s major systems. By completing a 4-point inspection, homeowners can ensure that their insurance policy covers any potential damage to these systems. Additionally, this inspection can help identify any potential hazards or safety concerns, allowing homeowners to address them before they become larger problems. Overall, investing in a 4-point inspection can provide peace of mind and financial protection for homeowners, particularly in areas like Florida where weather-related damage is a common concern.

During the inspection, insurance companies will typically ask for details about the age and condition of each system. They may also ask about any past repairs or replacements that have been made. One particular system that may raise questions during inspection is the electrical system. Insurance companies are likely to want to know the age of the system as well as its condition. If there have been any issues in the past, such as faulty wiring or outdated technology, it is important to disclose this information during the inspection. Insurance companies want to ensure the safety and reliability of your home’s electrical system, so it’s important to make sure it is up-to-date and in good working condition. If any upgrades or repairs are needed, addressing them before the inspection can help improve your home’s overall safety and insurability.

Again, the inspection may include details such as the age and condition of the property and its building materials. This helps to give insurance companies an understanding of the risks associated with insuring this particular home. They can then use this information to make sure that they provide appropriate coverage levels for their customers.

2. Items to Be Inspected During a 4-Point Inspection

The first point of inspection during a 4-point inspection is the electrical system. An inspector will check for outdated wiring, overloaded circuits and potential fire hazards such as faulty breakers. Insurance companies require these types of inspections because they need accurate information on the condition of the home in order to assess the insurance risk. It is important to remember that insurance companies want to limit their risk and minimize potential losses. So, by completing a 4-point inspection, homeowners can demonstrate that their home is a lower risk, which could qualify them for lower insurance rates. Taking the time to complete this inspection can provide peace of mind knowing that your home is safe and secure while also potentially saving some money on insurance premiums.

Florida residents know that homeowner’s insurance can be a bit tricky to navigate. One of the requirements for insurance providers in Florida is a 4-point inspection. This inspection focuses on the four main systems in your home: the roof, electrical, HVAC, and plumbing. The second point of inspection in a 4-point inspection is the plumbing system. The inspector will check for leaks, possible corrosion, and the age of the pipes to ensure they meet current building code standards. This is important because faulty plumbing can cause significant damage to your home and become an expensive problem down the line. By having a thorough inspection, insurance companies can assess the risk of providing coverage and ensure your home is up to code, ultimately providing you with peace of mind.

Next, the inspector will also assess the roofing on your property. They will check for any missing shingles or signs of damage that may not be perceptible from the ground. If any potential issues are found, appropriate documentation and photos will be taken so that it can be used should you choose to file a claim with your insurer in the future. The 4-point inspection is an important part of maintaining sound insurance coverage and protecting your home’s value over time.

3. Are There Any Preparations Needed Before A 4-Point Inspection?

It’s important to ensure all areas of the home are accessible for the inspector, including the HVAC system. Your HVAC (Heating, Ventilation, and Air Conditioning) system is an essential part of your home, and it’s important to make sure it’s in good working condition. This is especially important when it comes to insurance inspections, as a well-maintained HVAC system can help reduce the risk of potential problems or damage to your home. When scheduling an inspection, make sure to let the inspector know where your HVAC system is located, and ensure that it is easily accessible for them to check. Additionally, be sure to keep up with regular maintenance and cleaning to avoid any potential issues down the line. By taking these steps, you can ensure that your HVAC system is in great shape and your home is ready for inspection.

Homeowners should provide any relevant documentation or records related to the home’s systems when it comes to getting insurance and inspections. This will help the insurance company determine the condition and value of the systems and appliances in your home. It is important to have a comprehensive understanding of your insurance policy and what it covers. Some insurances require regular inspections to maintain coverage. Additionally, providing documentation and records can aid in finding potential issues with your systems before they become expensive repairs. It is always better to be proactive rather than reactive when it comes to the upkeep of your home and systems. Therefore, keeping track of all your home’s essential component documentation is an essential step in staying prepared.

Moreover, it is wise to have an insurance policy in place before conducting an inspection. This is especially important if any repairs or updates need to be made before the inspection takes place. Having a good insurance policy can provide peace of mind and financial protection against any damages or liabilities that may occur during the inspection process.

4. How Can Homeowners Ensure A Successful 4-Point Inspection?

Choose an experienced inspector who specializes in 4-point inspections and is familiar with the insurance company’s requirements. Insurers often require a 4-point inspection for homeowners insurance policies, so it’s important that you hire the right inspector. This type of inspection focuses on four specific areas of your home: plumbing, electrical, HVAC, and the roof. An inspector who is knowledgeable in all these areas can help you identify any potential problems that could cause issues with your policy. For example, during a plumbing inspection, the inspector will look for issues such as leaks, water damage, or inadequate water pressure. Identifying any issues ahead of time can help you save on costly repairs down the line and give you peace of mind knowing that your home is covered.

Prepare your home by making necessary repairs or upgrades before the inspection to ensure it meets all safety standards, including electrical safety. Electrical hazards have the potential to cause fire, shock, or other severe injuries, so it’s crucial to address any electrical issues before an inspection. Common signs of electrical problems could include flickering lights, burning smells, or frequently tripping breakers. To avoid any potential hazards, ensure that your electrical system is up to date and check for frayed wires and other signs of wear and tear. In addition to addressing any electrical concerns, make sure that your home has proper insurance coverage to protect against any unexpected incidents. Taking the time to prepare your home for an inspection can not only keep you and your family safe but also save you from costly repairs and insurance claims down the road.

Thereafter, it is important to keep any documents related to your HVAC system in a safe place so that you can present them quickly when requested by an inspector or insurance company. Receipts, statements, or reports of repair or renovation work need to be readily accessible in the event of an inspection. This will help ensure that insurance companies have all of the information they need and make the process easier for all parties involved.