Assignment of Benefits & the Florida Office of Insurance Regulation

The FLOIR Website Has a Section Dedicated to Assignment of Benefits.

The following is an excerpt from the Florida Office of Insurance Regulation website (https://www.floir.com/Sections/PandC/AssignmentofBenefits.aspx):

An Assignment of Benefits, or an AOB, is a document signed by a policyholder that allows a third party, such as a water extraction company, a roofer, or a plumber, to “stand in the shoes” of the insured and seek direct payment from the insurance company.

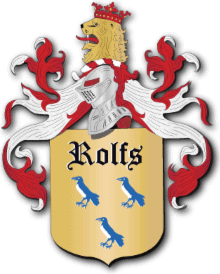

AOBs have been a part of Florida’s marketplace for more than a 100 years. Loopholes in the way it is being used in the marketplace are driving up costs for homeowners across the state due to unnecessary litigation associated with certain AOB claims. According to the Department of Financial Services, there were 405 AOB lawsuits across all 67 Florida counties in 2006, and that number had risen to 28,200 by 2016.

The Insurance Commissioner released a statement on September 10, 2018 regarding the current state of Assignment of Benefits abuse which may be read by clicking here.

Please click here to read the entire FAQ by the Florida Office of Insurance Regulation. It’s a short read and incredibly important.

What Is the Florida Office of Insurance Regulation (FLOIR)?

The Florida Office of Insurance Regulation was created by the Florida Legislature in 2003. It’s mission is to promote a stable and competitive insurance market for consumers. Their website, https://www.floir.com/, contains valuable and pertinent resources such as a rough rate comparison tool, news releases, industry reports, and a contact sheet for the largest homeowners insurance companies doing business in Florida.

The Florida Office of Insurance Regulation provides the general public with access to thousands of insurance company form and rate filings. The filings often include changes to wording within company forms and sometimes changes to rates. These filings are reviewed and approved/declined by the Florida Office of Insurance Regulation. The insurance company only notifies insurance agents of the changes once they are approved. Consumers vested in their own interest are able to view the filings for each insurance company at https://apps8.fldfs.com/IFileExternalSearch. The results returned will be sorted by product and filing type. The filings, sometimes voluminous, contain all supporting documents from analytics to copies of emails between the office and the insurance company. With enough time, consumers may review the filings to get a more thorough understanding of the actuarial data that contributes to Florida insurance rates. By reviewing pending filings, consumers can be one step ahead of insurance agents and even certain representatives of insurance companies, and better anticipate their financial cost for insurance coverage.